Rhine Transport 2022: Barge Containers, Volumes and outlook

| Written by Mark Buzinkay

No video selected

Select a video type in the sidebar.

Table of contents:

- Challenges and resilience: The state of container transport on the River Rhine in 2022

- What were the economic and environmental challenges of 2022 on the River Rhine?

- The impact on container transport

- Regional variances and responses

- The fleet and future innovations

- What is the status quo of the container traffic on the Rhine River?

- Outlook and future prospects

- FAQs

- Takeaway

- Glossary

Challenges and Resilience: The State of Container Transport on the River Rhine in 2022

The River Rhine, Europe's vital waterway, has long been the backbone of the continent's inland waterway transport (IWT), facilitating an intricate network of trade and logistics. Among its various cargo types, container transport stands as a critical component, connecting major ports and industrial hubs from Basel to the North Sea. However, 2022 presented unprecedented challenges that rippled the global economy, significantly impacting the IWT sector. Amidst geopolitical tensions, environmental adversities, and economic fluctuations, the resilience and adaptability of the Rhine's container transport network were tested. This article delves into the multifaceted impact of these challenges on container transport along the Rhine, leveraging insights from the Central Commission for Navigation on the Rhine (CCNR) Annual Report 2023. Through an analysis of the economic and environmental hurdles, regional responses, freight rate dynamics, and the evolving fleet landscape, we aim to provide a comprehensive overview of the state of container transport on the Rhine in 2022 and its prospects for recovery and growth.

What were The Economic and Environmental Challenges of 2022 on the River Rhine?

The year 2022 was marked by a series of global events that profoundly impacted the economic landscape, with the inland waterway transport sector bearing its share of the repercussions. The onset of the armed conflict between Russia and Ukraine introduced a new layer of complexity, disrupting trade routes and escalating commodity prices. Concurrently, the European economy grappled with an energy crisis that further exacerbated the situation for the IWT sector. Notably, all cargo segments, except for coal, experienced negative growth rates in transport volumes, underlining the widespread impact of these challenges.

The environmental conditions of 2022, particularly the low water levels observed during July and August, added another dimension of difficulty for Rhine navigation. The CCNR report highlights that between 2015 and 2022, 2018 and 2022 recorded the highest number of low water days, critically affecting transport efficiency and capacity. This confluence of economic and environmental adversities culminated in a significant downturn in cargo transport across the Rhine, with a notable -6.8% decrease compared to the previous year, emphasising the sector's vulnerability to external pressures.

The Impact on Container Transport

Container transport on the Rhine, a linchpin for European trade, faced considerable challenges in 2022, with a sharp -11.1% decline in volumes compared to 2021. This downturn can be attributed to a constellation of factors, including the Russia-Ukraine conflict, high inflation rates, and disruptions in global trade. Additionally, the environmental strain of low water levels in 2018 and 2022 significantly hindered cargo movement, compounding the losses from previous years and reflecting the stark reduction of container throughput.

The repercussions of these events were not uniform across the Rhine. The Traditional Rhine and Lower Rhine in the Netherlands experienced significant container transport declines, with reductions of -14.5% and -11.0%, respectively. These figures underscore the direct impact of the year's challenges on container transport and highlight the broader implications for the Rhine's role in European logistics and trade networks.

Regional Variances and Responses

The impact of 2022's challenges on container transport manifested differently across various regions along the Rhine, influenced by geographical, economic, and infrastructural factors. In the Netherlands, Germany, Belgium, and France, container transport metrics varied, reflecting each country's unique position in the Rhine's logistics network. As a leading country in inland waterway container transport, the Netherlands recorded a -9.8 % decrease in cargo transported in containers. In contrast, Germany and Belgium saw declines of -11.3 % and -8.6 %, respectively. France, however, experienced a slight growth of +3.8%, indicating regional disparities in the resilience and adaptability of container transport operations.

The geographical structure of the Rhine, particularly the dense delta network in the Netherlands and the critical industrial hubs along the Lower Rhine contributes to the higher transport intensity in these regions. Despite the overall downturn, specific inland ports and regions demonstrated resilience. Hamburg and the North Sea Port notably showed positive growth rates, contrasting with declines in major ports like Rotterdam and Antwerp-Bruges. This section underscores the importance of regional strategies and infrastructural strengths in mitigating the broader challenges the Rhine's container transport sector faces.

Learn more about the role of cold chain shipping in today's global trade.

The Fleet and Future Innovations

The economic and environmental adversities of 2022 significantly impacted freight rates across the Rhine's container transport sector. Driven by the dual pressures of low water conditions and shifting market demands, particularly the increased demand for coal transport, freight rates saw an average increase of +42.5%

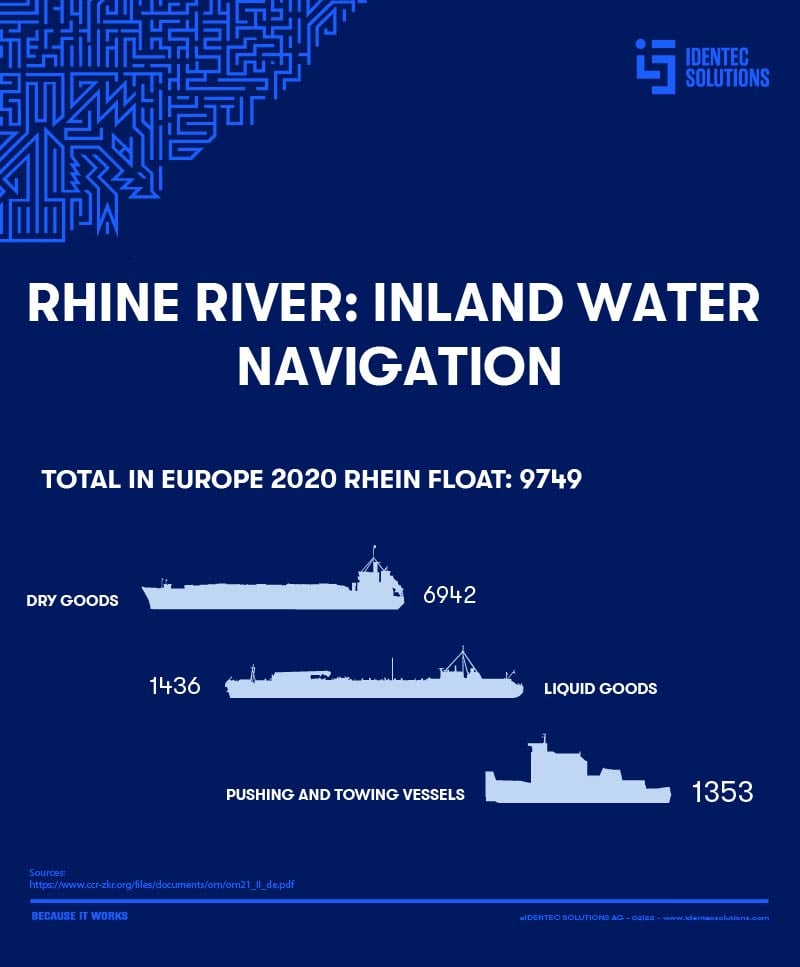

The fleet of inland vessels navigating the Rhine underwent significant changes in 2022, reflecting broader trends in the European inland waterway transport (IWT) sector. With almost 10,000 vessels registered in Rhine countries and additional fleets in Danube countries and other European nations, the diversity and capacity of the fleet are substantial. However, the year marked a moderation in new building activity, a continuation from 2021, influenced by the deteriorating transport demand conditions due to the pandemic and further exacerbated by the economic challenges of 2022 (see also our article about Danube transport).

Despite these challenges, the shift towards larger, more efficient vessels continued, particularly in the liquid cargo segment. This trend indicates a gradual evolution of the fleet towards higher capacity and potentially more environmentally friendly options, albeit current economic realities temper the pace of change. Innovations in the fleet aimed at reducing emissions represent a critical development area. Although innovative vessels account for less than 0.2% of the entire inland navigation fleet in Europe, their numbers increased significantly between 2021 and 2022. Although from a small base, this growth signals a positive shift towards sustainability in the sector.

Passenger transport, especially river cruises, offers an insight into the resilience of the IWT sector, with 2022 showing a remarkable rebound from the Covid-19 pandemic. The recovery of river cruises to pre-pandemic levels, particularly on the Upper Danube and the Moselle, albeit a slower recovery on the Rhine, underscores the potential for sustainable and innovative growth in both cargo and passenger segments of inland navigation.

Continue reading: Autonomous vessel on the Rhine

What is the status quo of the Container traffic on the river Rhine?

Based on the information provided from the CCNR Annual Report 2023, 2022 container transport on the Rhine experienced a significant reduction, with transport volumes dropping by -11.1% compared to 2021. This decline represents the most substantial year-on-year reduction since 2014, indicating a challenging period for container transport on the Rhine due to many factors, including low water levels, geopolitical tensions, and global trade disruptions.

Nevertheless, the importance of container trade on the river for the regions it traverses cannot be overstated. The Rhine is a key logistics artery in Europe, linking major seaports like Rotterdam, Antwerp, and Hamburg with the industrial heartlands of Germany, France, Switzerland, and other countries along its route. Container transport on the Rhine facilitates international trade. It supports regional economies by enabling the efficient movement of goods ranging from consumer products to industrial materials. It supports the operation of major ports, contributes to the economic development of inland regions, and plays a critical role in maintaining the competitiveness of European markets.

Moreover, the Rhine's container transport is vital for the operation of complex supply chains, providing a reliable and cost-effective means of transporting goods in bulk. This is particularly important for industries that rely on just-in-time delivery systems. The decline in container volumes in 2022 underscores these regions' challenges in maintaining trade flows and economic stability amidst external pressures.

Despite the downturn in 2022, the strategic importance of container transport on the Rhine remains high, underpinning the need for ongoing investments in infrastructure, technological advancements, and sustainable practices to enhance resilience and ensure the long-term viability of this crucial trade route.

For the rest ofFrance, see also the Rhone transport corridor.

Outlook and Future Prospects

Looking ahead, the outlook for cargo transport on the Rhine, and more broadly in the European IWT sector, is cautiously optimistic. From 2024 onwards, the market conditions are expected to improve, contingent upon resolving geopolitical tensions and stabilising the energy market.

The challenges of 2022, while significant, have also highlighted the resilience and adaptability of the Rhine's container transport sector. The ongoing innovations in vessel design and the gradual shift towards sustainability indicate a pathway for the industry to navigate future challenges more effectively. However, the volatile conditions from the armed conflict between Russia and Ukraine and the resultant energy crisis underscore the need for cautious optimism.

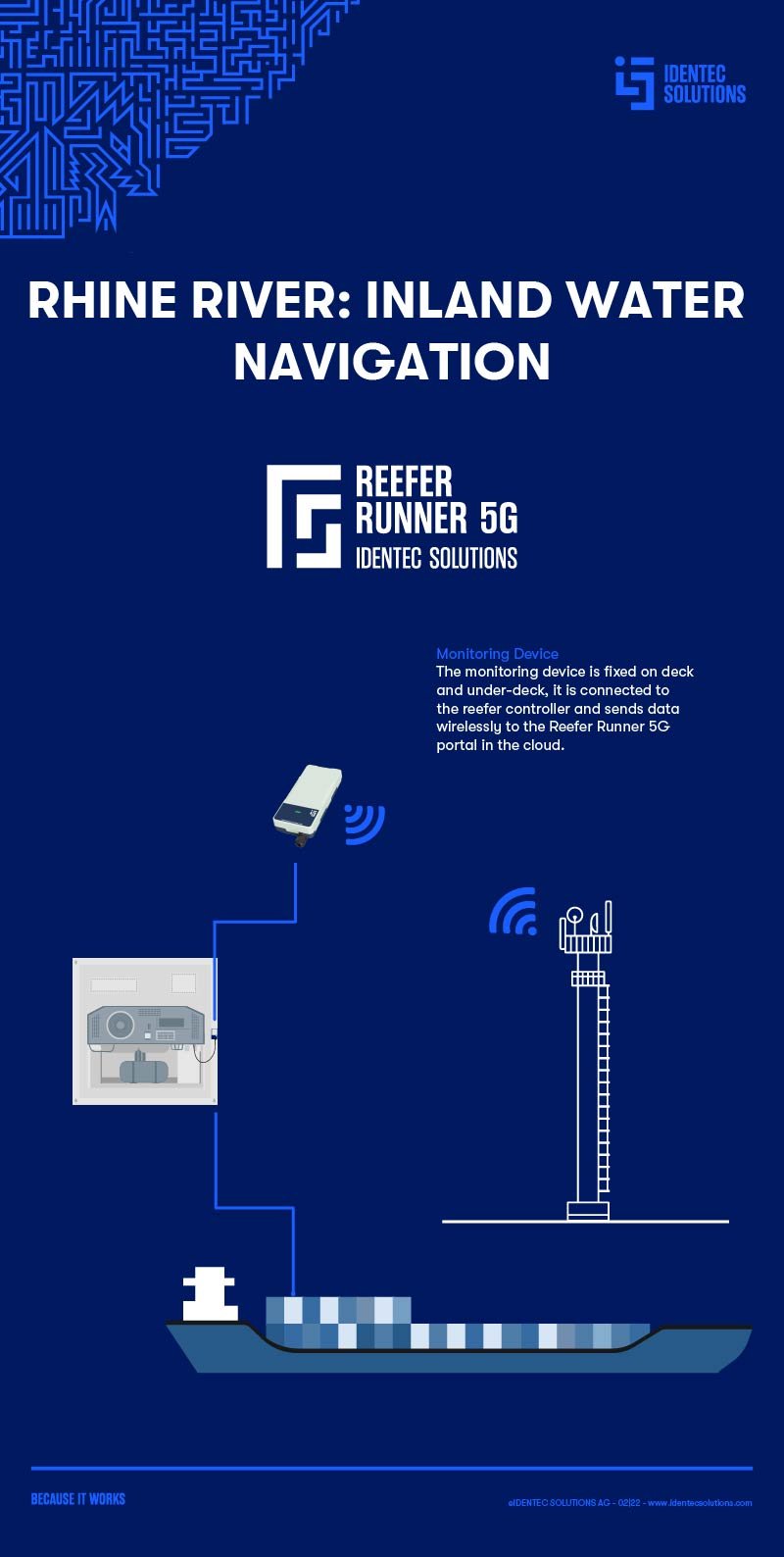

In conclusion, the future of container transport on the Rhine hinges on the sector's ability to adapt to external pressures, embrace innovation, and pursue sustainability. While challenges remain, the potential for growth and resilience in the face of adversity offers a hopeful outlook for the years ahead. As the geopolitical and economic landscape evolves, so will the strategies and technologies underpinning the success of container transport along Europe's vital waterways - see also River barge and reefer logistics.

FAQ: River Transportation on the River Rhine

How did the geopolitical events of 2022 impact container transport on the River Rhine?

The geopolitical tensions, particularly the conflict between Russia and Ukraine, had a significant negative impact on container transport along the River Rhine. These events contributed to a general economic downturn, disrupting trade routes and escalating commodity prices. Specifically, container transport volumes on the Rhine experienced a sharp decline of -11.1% compared to 2021. The conflict, coupled with other factors such as high inflation and disruptions in global trade, compounded the challenges faced by the inland waterway transport sector.

What were the main environmental challenges faced by Rhine transportation in 2022?

One of the primary environmental challenges faced by Rhine transportation in 2022 was the significantly low water levels, especially observed during July and August. These conditions critically affected the efficiency and capacity of transport operations, leading to increased transportation costs and reduced cargo volumes. The CCNR Annual Report 2022 highlights that 2022, along with 2018, recorded the highest number of low water days since 2015, underscoring the vulnerability of Rhine transportation to environmental factors.

What is the outlook for the River Rhine's container transport sector, and what factors could influence its future?

The outlook for the River Rhine's container transport sector is cautiously optimistic, with expectations of market improvement from 2024 onwards. This optimism is contingent on the stabilisation of geopolitical and economic conditions, particularly the resolution of the Russia-Ukraine conflict and the energy crisis. The sector's ability to adapt through innovations aimed at reducing emissions and improving vessel efficiency also plays a crucial role. However, the exact trajectory will depend on various factors, including environmental conditions, global economic trends, and the pace of technological adoption within the sector (see also: Cold chain components).

Takeaway

The River Rhine's container traffic experienced significant challenges in 2022, marked by an 11.1% volume decline, underscoring the sector's sensitivity to geopolitical tensions, environmental conditions, and global trade disruptions. Despite these obstacles, the Rhine's role in facilitating essential trade and logistics within Europe remains undiminished. Looking forward, the emphasis on technological innovations, sustainability, and infrastructure improvements presents an optimistic outlook. These advancements promise to mitigate future challenges and enhance the efficiency and resilience of container transport on the Rhine, ensuring its continued importance to the European logistics network.

Delve deeper into one of our core topics: Cold Chain Monitoring

Glossary

Bulk cargo refers to unpackaged goods transported in large quantities, typically loaded directly into a ship's hold. It is classified into dry bulk (e.g., coal, grain, minerals) and liquid bulk (e.g., crude oil, chemicals). Bulk cargo is transported using specialized vessels like bulk carriers or tankers. Efficient handling and storage systems, such as conveyor belts and pipelines, are crucial for managing bulk cargo, which plays a vital role in global trade.

Sources:

(1) https://inland-navigation-market.org/wp-content/uploads/2023/10/CCNR_annual_report_EN_2023_WEB-1.pdf

(2) Branch, A. E. Elements of Shipping. Routledge, 2012.

Note: This article was updated on the 11th of September 2025. This article was partly created with the assistance of artificial intelligence to support drafting. The head image was created by artificial intelligence.

Author

Mark Buzinkay, Head of Marketing

Mark Buzinkay holds a PhD in Virtual Anthropology, a Master in Business Administration (Telecommunications Mgmt), a Master of Science in Information Management and a Master of Arts in History, Sociology and Philosophy. Mark spent most of his professional career developing and creating business ideas - from a marketing, organisational and process point of view. He is fascinated by the digital transformation of industries, especially manufacturing and logistics. Mark writes mainly about Industry 4.0, maritime logistics, process and change management, innovations onshore and offshore, and the digital transformation in general.

Related Articles

Related Product