Reefer Trends Challenging Ports to Rethink Capacity and Capability

| Written by Constance Stickler

No video selected

Select a video type in the sidebar.

Table of contents:

- The Cold Chain's Pulse: Where the Reefer Market Stands Today

- Who's Still Building Reefers - and Who Isn't?

- Why Are We Running Short? The Global Reefer Demand Surge Explained

- What Do These Reefer Trends Mean for Terminals?

- Preparing the Terminal for 2030: What Operators Should Prioritise Now to Respond to Current Reefer Trends?

- FAQs

- Takeaway

- Glossary

The Cold Chain’s Pulse: Where the Reefer Market Stands Today

Once a niche product, refrigerated containers have become a mainstay of the global cold chain in recent years. New industries are increasingly being tapped as customers: In addition to traditional freight such as fruit and seafood, the refrigerated transport logistics sector also serves rapidly growing segments, including pharmaceuticals and fresh e-commerce products. For terminal operators and operations managers, understanding this development is essential: Demand is rising, but so are complexity and expectations.

Market Size & Growth: A Growing, Robust Market

The global refrigerated container market is currently experiencing strong growth. According to studies, its value was estimated at around US$10.8 billion in 2024 and is projected to reach US$16.2 billion by 2030, representing a compound annual growth rate (CAGR) of approximately 7%. (1) At the same time, the physical fleet of refrigerated containers is expanding. Analysts estimate that the market for refrigerated containers (in terms of value, not just quantity) will grow from around US$13.8 billion in 2024 to over US$26.5 billion in 2032. This growth will be supported by demand across the food, pharmaceutical, and other cold-chain industries. (2) This dual growth – in terms of both the number and the complexity and value of the containers – shows that the refrigerated container market is not only expanding, but also evolving in its composition.

Manufacturing Output & Dynamics

The production of refrigerated containers is currently at an all-time high. In the first nine months of 2025, over 321,000 TEU refrigerated containers were produced, with very high capacity utilisation due to strong demand. The market remains dominated by large Chinese manufacturers; for example, CIMC produced almost 150,000 TEU during this period, a significant increase from 2024. (3)

Leasing companies and shipping companies are undergoing a wave of decommissioning: Older refrigerated containers (typically 12-14 years old) are being decommissioned due to declining insulation, higher maintenance costs, and lower energy efficiency. In addition, environmental regulations and regulatory requirements are forcing manufacturers to develop refrigerated containers with more climate-friendly refrigerants and modern coatings. As a result, a significant portion of new production involves not only expanding existing containers but also replacing them. This demonstrates that renewal is an important part of today's production cycle.

Regional & Segment Reefer Trends

The Asia-Pacific region leads in demand and growth, thanks in part to its role as a major exporter of perishable goods and a hub for refrigerated container production. Among the application segments, traditional goods such as fruits, vegetables, and seafood, as well as new goods such as pharmaceuticals, are among the fastest-growing. The latter, in particular, is gaining importance rapidly: enormous growth is predicted for reefers specifically designed for pharmaceuticals, driven by biologics, vaccines, and other temperature-sensitive products. (4) Furthermore, specialisation is increasing, with a growing number of orders for multi-temperature refrigerated containers, CA (Controlled Atmosphere) units, and high-cube models. Newer models are therefore not only more numerous but also more technologically advanced.

Risks, Resilience & Market Tensions

Despite strong demand, the reefer market is not without risks. Production declined at times (for example, in 2023), indicating volatility. (5) Furthermore, price sensitivity remains a factor. Operating refrigerated containers is expensive, not only in terms of initial investment but also in terms of energy, maintenance, and regulatory compliance. Some leasing companies are prematurely decommissioning older, still-functional vehicles because inefficiencies and risks are no longer economically viable. At the same time, the value of fleets is increasing, partly due to technological upgrades – IoT, improved insulation, smarter systems – which make modern refrigerated containers more efficient but also more expensive to manufacture. This complexity increases the financial burden for lessors, freight forwarders, and shippers.

Strategic Implications for Terminals

Given the increasing number and technological advancements of refrigerated containers (which may entail higher energy demands), terminals must carefully plan power capacity, electrical outlets, and usage patterns.

As older refrigerated containers are phased out and replaced, the requirements for their condition (age, technological development) in depots and terminal facilities are changing – impacting maintenance, inspection, and storage.

To manage the volume of reefers requiring monitoring, digitalisation is essential. It is crucial to avoid data silos and integrate solutions directly into the Terminal Operating System (TOS). Terminals that can collect and respond to temperature, location, and alarm data will gain a competitive edge.

Refrigerated containers with more environmentally friendly refrigerants and improved insulation are expected to dominate new construction. Terminals that position themselves as "refrigerated container friendly" (e.g., with efficient power supply and low emissions) can attract more contracts from environmentally conscious operators.

A terminal's strength lies not only in its manageable volume, but also in its quality and complexity. The increasing replacement of older facilities, the rising demand for highly specialised refrigerated containers, and the technological advancements of the fleet mean that refrigerated containers will place entirely different demands on terminal infrastructure in the coming years than they did just a few years ago. Terminals that excel in terms of power supply, data, and maintenance will be successful; those that fail to do so may struggle to manage the increasingly complex cold chain.

Who’s Still Building Reefers — and Who Isn’t?

CIMC (China International Marine Containers)

CIMC remains the world's leading manufacturer of refrigerated containers. According to its interim report, refrigerated container sales were very strong in the first half of 2025, reaching 92,000 TEU, a significant increase from 44,700 TEU in the same period of the previous year. (6) Given the rising demand and the phasing out of older refrigerated containers, CIMC is well-positioned to benefit from the replacement cycle.

Maersk Container Industry (MCI)

MCI's refrigerated container production is increasing. In the first nine months of 2025, the company produced 58,590 TEU – more than double the amount produced in the same period of the previous year. The company is focusing on highly energy-efficient units (Star Cool) and special lines with controlled atmosphere (CA).

Singamas Container Holdings

Singamas is and remains an important player in the refrigerated container market; the company also manufactures CA refrigerated containers. (7)

Daikin (Reefer Division)

While the company is primarily known for its refrigeration units, it is also a leading manufacturer of refrigerated containers. Its strength lies in integrating high-performance refrigeration technology into refrigerated containers.

Smaller / Niche Players

Other suppliers, such as Sea Box, CXIC Group, and others, produce in smaller quantities or specialise in niche types.

Who Isn’t Scaling Up — and Why Some Are Pulling Back

Given the high demand for smart and specialised refrigerated containers (e.g., with telemetry, CA), older or less automated plants are finding it increasingly difficult to remain competitive. Companies that have not invested in automation or advanced wastewater/coating systems are finding it harder to deliver profitably during this boom.

Some manufacturers are prioritising specialised refrigerated containers (e.g., pharmaceutical-grade) over mass production. This means they are building fewer containers overall, but of higher quality; the focus is less on the sheer TEU capacity and more on specifications.

Built in One Place, Shipped Everywhere: The Manufacturing Risk One Can’t Ignore

Almost all major refrigerated container manufacturers produce their containers in China, creating a highly concentrated global supply. This means that any disruption – be it due to regulatory requirements, labour shortages, or energy bottlenecks – can affect the entire international fleet and make terminals vulnerable.

Why Are We Running Short? The Global Reefer Demand Surge Explained

The Demand Drivers

The reasons for the recent surge in demand for refrigerated containers and the manufacturers' response are impacting terminal reefer operations:

Accelerated growth in perishable goods trade: Global demand for perishable goods—particularly South American fruit [Link to article "https://www.identecsolutions.com/news/fruit-export-the-journey-from-brazilian-orchards-to-european-tables"?] and seafood from key exporting countries—has increased both in volume and reach (more direct long-haul routes to Asia and Europe). Seasonal demand peaks have become larger and more frequent, and shippers are expanding their capacity to capitalise on these periods. This is one of the most obvious and immediate reasons for the short-term shortage of refrigerated containers.

Expansion of the cold chain in the pharmaceutical industry: The pharmaceutical industry is transforming into a highly sought-after customer, handling larger volumes than ever before. However, the growth in biologics and temperature-sensitive pharmaceuticals necessitates certified, traceable cold chain capabilities with rigorous temperature control and monitoring—often requiring specialised vehicles and documentation. This is driving demand for newer refrigerated containers and reducing lead times for compliant vehicles.

Expectations of e-commerce and retail: Direct-to-consumer food sales and subscription meal kits are increasing demand for door-to-door refrigerated logistics and, consequently, for refrigerated containers on certain trade routes. These shipments are typically more time-sensitive, encouraging investment in newer refrigerated containers with enhanced telemetry and condition reporting.

Impact of freight rates and routes: Higher freight rates and trade disruptions (e.g., route changes due to geopolitical risks or port congestion) can lengthen transit times. Longer journeys mean refrigerated containers are tied up for longer periods per trip—effectively reducing available fleet capacity and leading to higher short-term demand for additional units. The dynamics of the shipping industry are therefore indirectly increasing the demand for refrigerated containers.

Leasing and fleet adjustments: Leasing companies, which cover a large portion of the refrigerated container demand, are responding to market signals by increasing their orders and holding onto vehicles for longer periods. This impacts the used market and the availability of short-term rentals, increasing pressure on manufacturers to deliver new refrigerated containers quickly. Industry reports show a recovery in refrigerated container production volumes compared to the declines in dry container production. (8)

New regulatory and sustainability factors: Regulations concerning refrigerants and energy efficiency are prompting buyers to purchase newer, compliant equipment (or undertake costly retrofits). This is driving demand for new refrigeration units with approved refrigerants and improved energy efficiency—thus shifting demand toward modern production lines rather than older, used equipment.

How those demand forces are changing manufacturing

- Demand for smarter, standards-compliant refrigerated containers is driving manufacturers to produce feature-rich models with integrated telemetry, improved insulation, and advanced compressors, which is increasing lead times.

- Production capacity is shifting toward higher-margin specialty containers, reducing the supply of basic models and tightening the used market.

- With production largely concentrated in a few Chinese manufacturing centres, factories are quickly reaching capacity limits, leading to regional bottlenecks during peak demand.

- Supply chain constraints are further slowing production, particularly for smart containers.

- Given the high demand and limited capacity, new build prices and leasing rates are rising, prompting operators to keep older refrigerated containers in service longer—an imperfect but necessary buffer.

What Do these Reefer Trends Mean for Terminals?

Power, Plugs, and Pain Points

The surge in global demand for refrigerated containers has far-reaching implications for container terminals. Unlike dry containers, refrigerated containers create a continuous operational and energy load from the moment they arrive at the terminal. Every additional refrigerated container arriving during peak season demands extra scarce power connections, technician hours, monitoring resources, and electrical stability.

The trend toward more refrigerated containers has become a structural challenge, impacting berth planning, terminal space allocation, investment timelines, power procurement, and even CO₂ intensity reporting. In short, the growth in refrigerated container demand is no longer just a statistic. It's a stress test.

The demand curve for power connections: No longer seasonal, no longer smooth

Historically, the demand for power connections followed relatively predictable seasonal fluctuations—fruit export seasons, fishing campaigns, and the Christmas retail season. The market has changed in three key ways:

- Demand is higher overall and more volatile, and refrigerated cargo flows have diversified. Individual goods overlap more during their seasonal peaks. Non-traditional refrigerated cargo types (such as highly sensitive electronics and specialty chemicals) also contribute to the overall volume.

- Refrigerated containers are concentrated on specific trade routes, particularly North-South and Asia-Europe, and the units can arrive at terminals in concentrated waves.

- Shipping companies' behaviour exacerbates peak loads, as they increasingly position empty refrigerated containers in strategic markets before seasonal peaks. However, these empty containers also require power outlets—often for diagnostics or firmware updates—even before they are loaded.

Power Infrastructure: The Silent Bottleneck

More refrigerated containers mean more power—and in many terminals, the power supply is becoming the real bottleneck. Expanding the number of outlets is easy; increasing the megawatt rating, however, is not.

The power grids were not designed for today's refrigerated container loads. Many terminals were designed for a time when refrigerated containers accounted for only 2–5% of storage space. Today, some global exporters see refrigerated container usage reach 20–30% on peak days.

Even where physical capacity exists, contractual restrictions with energy suppliers can lead to unpleasant consequences such as peak-load penalties, emergency power outages, and expensive short-term energy procurement.

Diesel generators, temporary sockets, or mobile power units can fill gaps—but few terminals have reserve capacity that corresponds to the actual worst-case scenario: one ship arrives early, another late, and the shipyard is already operating at 80–90% capacity.

Yard Space and Layout

Power is only half the battle. Space is the other half.

- Refrigerated container stacks are getting taller, but more fragile. Increased use of vertical storage capacity is causing greater problems with air circulation, heat buildup, and more difficult access for technicians. Refrigerated containers are becoming increasingly difficult to reach in the event of a malfunction, especially in densely populated areas deep within the city.

- Fleets of varying ages and technology levels complicate planning, particularly with refrigerated containers that have high energy consumption (unstable voltage due to temperature fluctuations).

- The more connectors in a rack, the higher the security risk. Layout decisions now require a holistic approach: energy optimisation, technician accessibility, and monitoring intensity.

Skills Shortage

Even the most modern terminal systems rely on qualified reefer technicians who can interpret alarms, maintain equipment, and respond quickly. Increasing volumes of refrigerated containers have exposed several structural problems: Technical teams have not grown with demand, and qualification requirements have expanded to include electronics, telemetry systems, sensor calibration, secure remote control, and firmware diagnostics.

Energy Costs and Energy Strategy

Refrigerated containers account for a disproportionate share of a terminal's energy costs. As electricity prices rise, the electricity costs for refrigerated containers become one of the largest variable cost factors in the terminal's profit and loss statement.

Despite rising energy prices, shipping companies often negotiate aggressively over electricity tariffs for refrigerated containers to limit cost pass-through. Terminals are under pressure: They bear the electricity costs but do not always receive a proportional share of the revenue.

Sustainability

Sustainability efforts increase the pressure; many ports have committed to reducing their emissions—this is made more difficult by reefers if the grid's electricity mix has a high carbon footprint.

On the other hand, this development creates incentives for:

- Solar and battery systems to compensate for the electricity consumption of refrigerated containers

- Dynamic energy management

- Retrofitting sockets with smart metering technology

- Reporting tools to record electricity consumption in kWh per unit, per product, and per customer

Pain Points That Terminals Can No Longer Ignore

An increasing number of refrigerated containers leads to structural weaknesses:

-

Power outages lead to service disruptions. Shipping companies increasingly demand a guaranteed power supply; the inability to provide this jeopardises business relationships.

-

The flood of alarms overwhelms teams. Without filtering, a single stormy night can trigger hundreds of alarms.

-

Unplanned transshipments increase dramatically. Inspections of refrigerated containers and alarm-related interventions result in more crane hours and more frequent restructuring in the terminal area.

-

The energy infrastructure becomes a multi-year bottleneck. Expanding grid capacity often requires years, permits, and negotiations with energy suppliers.

-

Pharmaceuticals and high-value cargo demand absolute tolerance for errors. Documentation must be complete, responses must be immediate, and deviations must be traceable.

Terminals that treat refrigerated containers as "special cargo" on the periphery will face difficulties. Terminals that consider refrigerated containers a core process gain resilience, market differentiation, and pricing power.

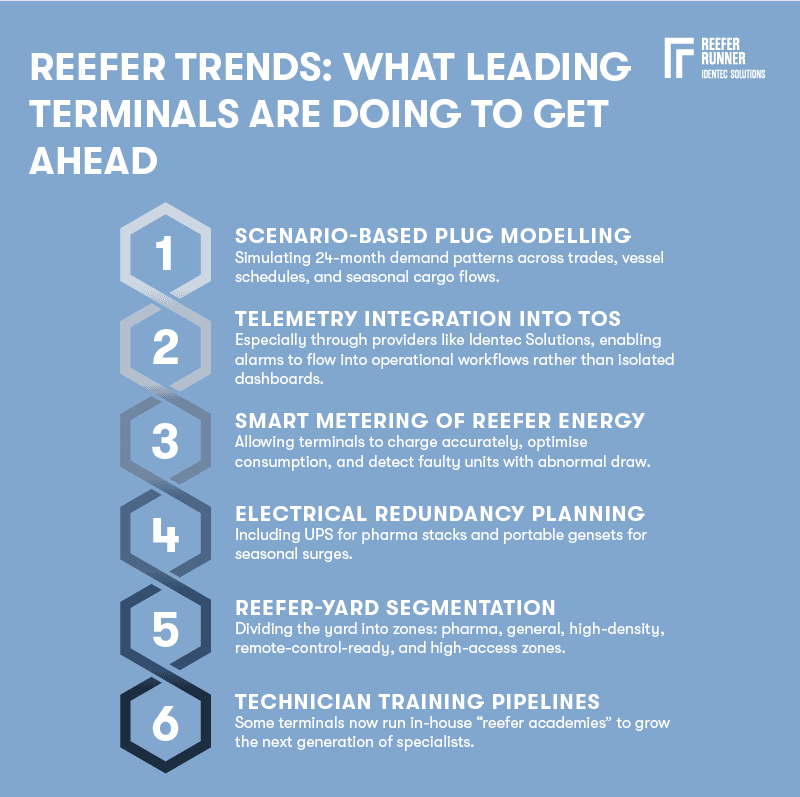

Preparing the Terminal for 2030: What Operators Should Prioritise Now to Respond to Current Reefer Trends

The year 2030 is fast approaching. The refrigerated reefer market is growing, technology cycles are accelerating, and shippers are demanding reliability and transparency to a degree that was unimaginable a decade ago. Terminals that want to remain competitive and avoid being trapped in a constant state of crisis management must use the next five years as a window of opportunity for structural investment, not incremental solutions. Preparing for 2030 is not just a technical challenge; it requires organisational change encompassing energy, site design, personnel, digital maturity, and even commercial positioning.

What needs to be done?

Terminals that want to remain competitive and avoid being trapped in a state of perpetual crisis management must use the next five years as a window of opportunity for structural investment, not incremental solutions. - Develop a future-proof power supply strategy – not just more outlets

Redesign terminal facilities for refrigerated container access, security, and efficient technician workflows

- Invest in your technicians' capacity, skills, and automation

- Standardise data flows across systems – not just additional screens

- Prepare for a higher proportion of cargo with zero-tolerance requirements

- Modernise through digital twins, predictive maintenance, and refrigerated container analytics

- Establish a cross-functional "Refrigerated Container Committee" to break down silos

- Strengthen the terminal's commercial positioning – refrigerated containers as a unique selling proposition

- Plan refrigerated container infrastructure modernisations on a 10-year cycle, not with 2-year solutions

FAQ

Why Are Some New Reefer Containers Showing Rust More Quickly?

In 2021, major Chinese manufacturers such as CIMC, DFIC, and Fuwa Guangdong replaced traditional hot-zinc spray and solvent-based paints with environmentally friendly zinc-rich primers and waterborne coatings. While greener, this new coating system has proven less durable, leading to earlier discolouration and rusting — especially in sub-tropical, high-humidity trade lanes where cosmetic wear accelerates.

Although the structural integrity of the containers is generally unaffected, appearance matters: shippers of fresh produce, pharmaceuticals, and other temperature-sensitive cargo often avoid boxes that look aged or poorly maintained. As a result, carriers risk losing business simply because their newer, eco-coated reefers look older than they are, creating a commercial dilemma between sustainability compliance and customer perception.

Takeaway

Growth in refrigerated container traffic is accelerating faster than most terminals can adapt. This market is expanding in both volume and complexity, driving higher energy demand, more intensive monitoring requirements, and higher shipper expectations. For ports, the message is clear: refrigerated containers are becoming a core part of operations, not the exception. Terminals that upgrade their power supply, digital integration, technician skills, and site design now will gain resilience and a competitive edge—while those that hesitate risk being overwhelmed by the increasingly complex cold chain.

Delve deeper into one of our core topics: Refrigerated containers

Glossary

A controlled atmosphere (CA) is a technology that regulates the composition of gases—primarily oxygen, carbon dioxide, and nitrogen—to preserve perishables like fruits and vegetables during transport. By reducing oxygen and increasing CO₂, CA slows down respiration and ripening, significantly extending shelf life. Additionally, temperature and humidity are tightly managed, while sensors ensure optimal conditions are maintained throughout the journey. This method enables shipment of sensitive cargoes over long distances without spoilage, meeting global supply chain demands for fresh produce. (9)

Direct-to-consumer (DTC) refers to a business model in which brands sell products directly to customers, bypassing third-party retailers, distributors, or wholesalers. This approach, often enabled by e-commerce platforms, allows companies to control pricing, customer experience, and marketing communication while building direct relationships with buyers. DTC models have become popular for improving profit margins, gathering customer data, and offering personalised service, especially through digital channels. (10)

References:

(1) https://www.marketresearch.com/Global-Industry-Analysts-v1039/Reefer-Containers-42751974/

(2) https://www.futuremarketreport.com/industry-report/fleet-of-reefer-containers-market

(3) https://www.worldcargonews.com/refrigeration/2025/11/reefer-container-output-rises/

(4) https://marketsquareinsights.com/global-reefer-container-for-pharmaceutical-market

(6) https://www.hkexnews.hk/listedco/listconews/sehk/2025/0925/2025092500849.pdf

(8) https://hansa.news/container-manufacturers-anticipate-falling-demand/

(9) UK P&I Club (2023). Carefully to Carry: Refrigerated Container and Controlled Atmosphere Cargoes.

(10) Chaffey, Dave (2022). Digital Business and E-Commerce Management. Pearson.

Note: This article was partly created with the assistance of artificial intelligence to support drafting.

Author

Conny Stickler, Marketing Manager Logistics

Constance Stickler holds a master's degree in political science, German language and history. She spent most of her professional career as a project and marketing manager in different industries. Her passion is usability, and she's captivated by the potential of today's digital tools. They seem to unlock endless possibilities, each one more intriguing than the last. Constance writes about automation, sustainability and safety in maritime logistics.

Related Articles

Related Product